General Election Commentary 3 Published 31st July 2024

In this commentary, I will argue that the so-called ‘Black Hole‘ in the Treasury’s finances is a misconception. Instead, the real issues lie with an out-of-control Central Bank and a deeply flawed Treasury team. I’ll explore these dynamics in detail and shed light on the broader implications for economic policy and governance.

Anthony Royd

I will discuss the the outcome of the General Election, the negative impact of Labour’s policies and publish Royd’s ‘Ground-breaking Solution to the Illegal Migrants and Refugee Crisis’.

The General Election has produced a government that is lead by Sir Keir Starmer, a former Director of Public Prosecutions (not a traditional civil service role but significant within The Home Office). — Rachel Reeves, Chancellor of the Exchequer, has worked at both HM Treasury and the Bank of England. — Sue Gray, a former Director General of Propriety and Ethics at Cabinet Office, now Sir Kier Starmer’s Chief of Staff.

With the Prime Minister, Chancellor of the Exchequer and PM’s Chief, all with senior positions across government departments, there is no one with the ability to reform control of governance that I discussed in the last commentary — it’s a Civil Service Coup by Mandarins, or Is It Me!

It might seem obvious, but a government must be free to govern—yet they cannot. Every aspect of control by the members of the House of Commons has been ceded to unelected officials, whether it be Civil Service Mandarins or one of the approximately 766 Quangos. This figure includes various types of public bodies such as non-departmental public bodies (NDPBs) and other arm’s-length government organisations.

As if that isn’t enough, former civil servant Sir Keir Starmer proposes even more restrictions. His first move appears to be taking away the House’s prerogative to analyse and debate the Government’s Budget by upgrading the status of the Office for Budget Responsibility, leading to more civil servants being involved in governance.

I don’t engage in politics, but I passionately care about social justice and democratic responsibility, and this shift raises concerns about UK democracy being overshadowed by the state.

MPs not holding government positions (Back Benchers) are supposed to debate the pros and cons of new bills or government proposals. However, the Government’s Back Benchers are effectively just lobby fodder, as their votes are controlled by the Party Whip system. This should only be allowed for proposals included in the party’s manifesto.

All of the above means there is very little chance of governance that is able to maintain stability in the banking system, reduce the tax burden, control inflation in a manner that avoids increasing the burden on working families and the vulnerable, while stimulating growth by providing protections and incentives for small and medium-sized businesses.

I will however, persist, as all the monetary policies to achieve the government objectives above are contained in ‘The Royd Monetary Policy’

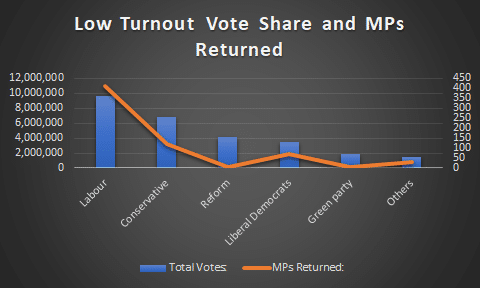

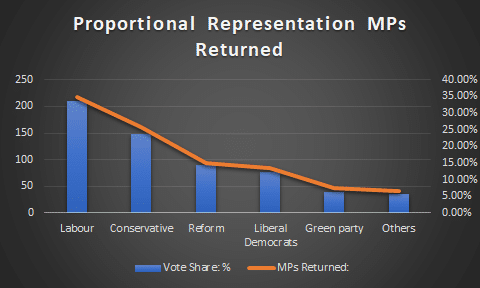

MP’s returned by First Past the Post as a percentage and actual votes cast. The third graph depicts seat allocation by Proportional Representation

The Vote Share graphs depict how with the ‘First Past the Post’ system a single candidate can win all representation from a district, despite not receiving majority support.

Proportional representation aims to allocate seats in a way that mirrors the overall vote distribution among various political groups.

Labour’s Monetary Policy

I am not sure that Labour has a clear monetary policy. So far, the Chancellor, Rachel Reeves MP, has only announced harsh taxes aimed at schoolchildren and the elderly, likely because they promised not to tax workers. From this, we can infer that the frail, sick, and vulnerable will bear the brunt of her policies—this could have serious consequences for their lives.

The winter fuel payment has been a lifesaver for many elderly people, often living on the edge of poverty with only a small works pension. Pride prevents them from begging for help, as it is not how they were raised.

I do not have any legal training, so I ask: “is it tenable that Ms. Reeves could be held accountable for the rise in deaths next winter when fuel bills are expected to rise—and they will?“ The energy sector is quick to take advantage of any given situation.

Typical household energy bills increased by 54% in April 2022 and 27% in October 2022. Lower wholesale prices have led to falls in prices, but bills remain around 29% above their winter 2021/22 levels. The price cap is forecast to rise by 10% in October 2024 and remain around this level for the rest of winter 2024/25. With little prospect of savings from fixed tariffs or a return to pre ‘energy crisis’ prices, the only way to substantially reduce energy bills, while still adequately heating/powering homes, is to improve the energy efficiency of properties (sic). From the House of Commons Library (Doc: 9491), so not knowing is no excuse Ms Reeves.

To avoid the inevitable increase of deaths from hyperthermia amongst the elderly, is Ms Reeves going to announce grants for improving housing insulation and other energy saving measures?

Reeves Taxes Olympian Hopefuls

A study by the Good Schools Guide implies that Rachel Reeves’ taxes affect a third of British female Olympians. Since the 2016 Olympic Games, 33% of female athletes have been educated at private schools, despite only 9% of the population attending these schools.

VAT of 20% levied on private schools from January 2025 and to remove business rates relief, is Nasty and Vindictive, borrowing a phrase from Mr. Bates, you are a ‘Nasty in a Suite’. It is doubtful that the taxes will raise much money and may put even more pressure on state schools.

The 2023 IFS analysis argued that the effect of the Labour Party’s proposed VAT changes on the number of pupils attending independent schools is “clearly uncertain” and subject to significant error without direct evidence.

Reeves Needs to Raise Taxes Due to a Surprise £22bn Black Hole

Ms. Rachel Reeves has faced significant criticism in the media for allegedly being unaware of the previous government’s underfunding. This scepticism is understandable, given that she has worked at both HM Treasury and the Bank of England and in opposition had open access to ‘The Office for Budget Responsibility’ (OBR) reports.

Is there a ‘Black Hole’, or ‘No Black Hole’?

Answer: ‘No Black Hole’, only an out-of-control Central Bank (Bank) and an incompetent Mandarin team in the Treasury. Incompetent because they have failed to advise and ensure that the Chancellor is aware of all facts and implications of fiscal policy and relate the policy to the Bank.

Empowerment 1

The £22 billion shortfall can be effectively managed by reverting the Bank Levy to ‘Non-Remunerated Reserves’, as the Bank Levy reclassifies a proportion of profits as costs, which reduces the Tax contribution to HMT.

As of June 2024, the Bank of England held nearly £700 billion in its Asset Purchase Facility (APF), which contains the assets acquired during the quantitative easing program. The Bank currently pays interest on these assets at the prevailing Bank Base rate of 5.25%. A conservative calculation based on £600 billion at 5.25% yields £31.5 billion, which more than covers the £22 billion gap.

Empowerment 2

The Black Hole is significantly less than the conservative estimate of £31.5bn, which could be as high as £36bn. Therefore, the interest rate payable on APF could be reduced 0%, similar to Japan, that also has an excess APF from a quantitative easing program.

Notably, only the Bank of England pays the full base rate on excess reserves. The Bank of Japan currently pays an interest rate of -0.10% on excess reserves. The G7 central banks do not uniformly pay the full Bank base rate; many pay lesser amounts or have varying structures for their reserve payments, which also reduces the cost of servicing their cash reserves. I believe the two approaches offer a viable and fiscally responsible solution to the issue at hand.

So! No Black Hole, or ‘Is It Me!’

Can the banks afford it? Yes, they can. In the financial year to February 23, 2024 the Big Four UK banks — Lloyds, NatWest, Barclays and HSBC — announced pre-tax profits of £44.3 billion, thanks to the largess of the out-of-control Bank of England

Using the excess money from reverting the Bank Levy to non-remunerated reserves, or variable low interest reserves in conjunction with increasing Cash Ratio Deposits, there is sufficient money to meet all the demands, so there is no need whatsoever, for the Chancellor to implement the nasty, despicable attack on private schools.

No Need to increase Taxation to further Growth

The Royd Monetary Policy will enable low-cost finance at no cost to the Treasury and will encourage inward investment into growth areas of the economy.

It has been reported by BDO UK that 500 mid-sized businesses, which generate a turnover of between £10m-£300m each and account for one in four UK jobs, reveals that almost two fifths plan to direct the majority of their investment within the UK (sic).

Labour’s solution is to use Taxpayers money, £7.3 billion to Create the National Wealth Fund to be distributed by yet another Quango.

Bang-goes another load of money into the now Labour’s Black Hole, or ‘Is It Me!

Planning and Infrastructure Bill

The Planning and Infrastructure Bill is yet another hollow promise in the King’s Speech. The bill purports to reform the planning system, empower local authorities, and ensure fairness for landowners facing compulsory purchase orders.

However, the insincerity of these promises is evident in the actions of Energy Secretary Ed Miliband. His first move was to overrule the Planning Inspectorate and a host of regional government officials who opposed the proposed Sunnica site, a 7-square-mile development near Newmarket racecourse.

This site will severely harm the horseracing industry and eliminate valuable irrigated vegetable-growing land. This is a blatant disregard for local opposition, the impact of the suggested development on the landscape, local biodiversity, and transport links in and around East Cambridgeshire.

The bill’s supposed principles expose the true nature of this legislation as a mere façade, or ‘Is It Me!’

Border Security, Asylum and Immigration Bill

The establishment of a new Border Security Command is a promising development, and we wish it success in its mission to ‘Smash the Gangs.’ This initiative is reminiscent of Tony Blair’s “Be Tough on Crime” campaign, which marked a significant shift in UK crime policy by integrating strict law enforcement with efforts to address socio-economic factors contributing to criminal behaviour.

While there was a notable reduction in crime rates during the late 1990s and early 2000s, the initiative’s long-term success depended on sustained efforts to tackle the root causes of crime, along with maintaining effective policing and justice systems. Unfortunately, these efforts have faltered due to a lack of funding in both the police and the justice system, as we witness almost daily sickening scenes of knife attacks, mob attacks on police and rioting in our suburban streets.

In contrast, Starmer has no concrete policy to address the root causes of illegal immigration, offering only vague notions of improving relations with the EU.

In my main article below, I propose a realistic solution: sheltering migrants on some of the many islands that surround our coasts.

By a twist of fate, an ideal island has just presented itself. ‘Torsa’, a tidal island in Scotland, instead of becoming an Islamic state, it could become the first refugee camp. It is currently for sale, and the Royd Illegal Migrants and Refugees Initiative’s compensation package is sure to win support from the locals.

In less than three months and at a very low cost, compared to the Rwanda Policy, the UK, by adopting ‘The Royd Illegal Migrants and Refugees Initiative’ could have its first off shore processing centre that cannot be challenged by any court, or ‘Is It Me!’

Calling on Reform’s Nigel Farage to propose it to the House and have the House debate and vote on it. A deterrent to illegal migrants and a safe refuge for asylum seekers, or ‘Is It Me!’